NVIDIA Corporation (NVDA) is a leader in the technology industry, specializing in the design and manufacture of graphics processing units (GPUs) and high-performance computing hardware. As one of the most successful and innovative companies in the sector, NVIDIA's stock has been a subject of interest for investors and market analysts alike. In this article, we will provide an overview of NVIDIA's stock price, analyze its performance, and discuss the factors that influence its value.

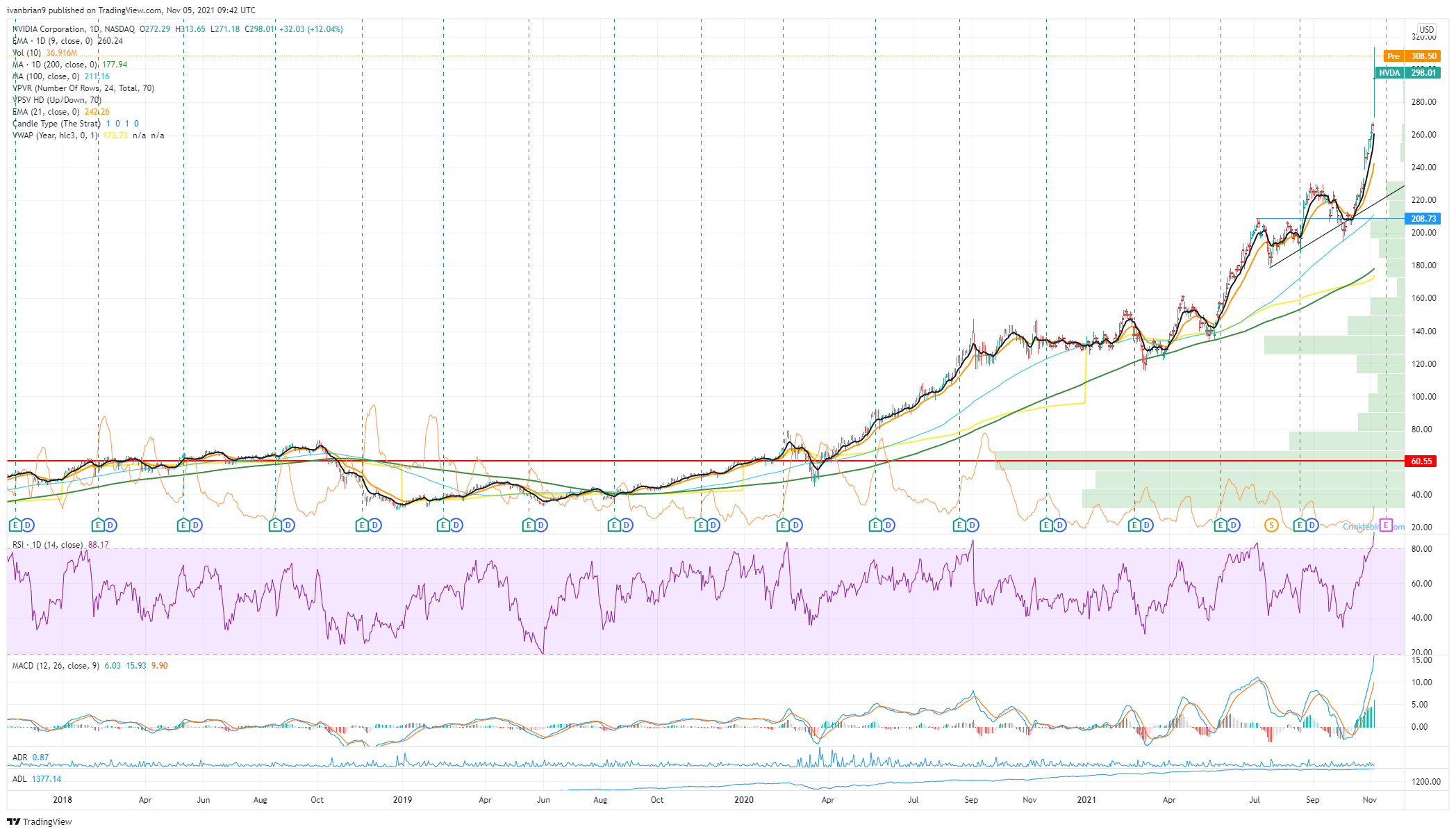

Current Stock Price and Performance

As of the latest market update, NVIDIA's stock price has been experiencing a significant surge, driven by the growing demand for its products in the gaming, artificial intelligence, and data center markets. The company's stock has consistently outperformed the broader market, with a year-to-date return of over 50%. This impressive performance can be attributed to NVIDIA's strong financials, innovative product lineup, and strategic partnerships.

Financial Highlights

NVIDIA's financial performance has been impressive, with revenue growth driven by its GeForce, Quadro, and Tesla product lines. The company's quarterly revenue has consistently exceeded analyst expectations, with a significant increase in gross margin and operating income. NVIDIA's strong financials have enabled the company to invest in research and development, driving innovation and expanding its product offerings.

Stock Analysis and Trends

NVIDIA's stock has been trending upward, driven by several factors, including:

Gaming Market Growth: The gaming market is experiencing significant growth, driven by the increasing popularity of cloud gaming, esports, and virtual reality. NVIDIA's GeForce GPUs are widely used in gaming PCs and consoles, making the company a key beneficiary of this trend.

Artificial Intelligence and Deep Learning: NVIDIA's GPUs are also used in artificial intelligence and deep learning applications, including natural language processing, computer vision, and autonomous vehicles. The growing demand for AI and deep learning solutions is driving NVIDIA's revenue growth.

Data Center Expansion: NVIDIA's data center business is expanding rapidly, driven by the increasing demand for cloud computing, storage, and networking. The company's Tesla and Quadro products are widely used in data centers, making NVIDIA a key player in this market.

Risks and Challenges

While NVIDIA's stock has been performing well, there are several risks and challenges that investors should be aware of, including:

Competition: The technology industry is highly competitive, with companies like AMD and Intel competing with NVIDIA in the GPU market.

Regulatory Risks: NVIDIA's business is subject to regulatory risks, including trade tensions and tariffs, which can impact the company's revenue and profitability.

Economic Uncertainty: Economic uncertainty, including recession and trade wars, can impact NVIDIA's revenue and profitability.

NVIDIA Corporation (NVDA) is a leader in the technology industry, with a strong track record of innovation and financial performance. The company's stock has been trending upward, driven by the growing demand for its products in the gaming, artificial intelligence, and data center markets. While there are risks and challenges that investors should be aware of, NVIDIA's strong financials, innovative product lineup, and strategic partnerships make it an attractive investment opportunity. As the technology industry continues to evolve, NVIDIA is well-positioned to drive growth and innovation, making its stock a compelling choice for investors.

Note: This article is for informational purposes only and should not be considered as investment advice. Investors should do their own research and consult with a financial advisor before making any investment decisions.