As a responsible individual, you work hard to save and manage your finances. However, have you ever stopped to think about the safety of your deposits? In the United States, the Federal Deposit Insurance Corporation (FDIC) plays a crucial role in protecting depositors' funds. In this article, we will delve into the world of deposit insurance, exploring what it is, how it works, and the benefits it provides to individuals and businesses.

What is Deposit Insurance?

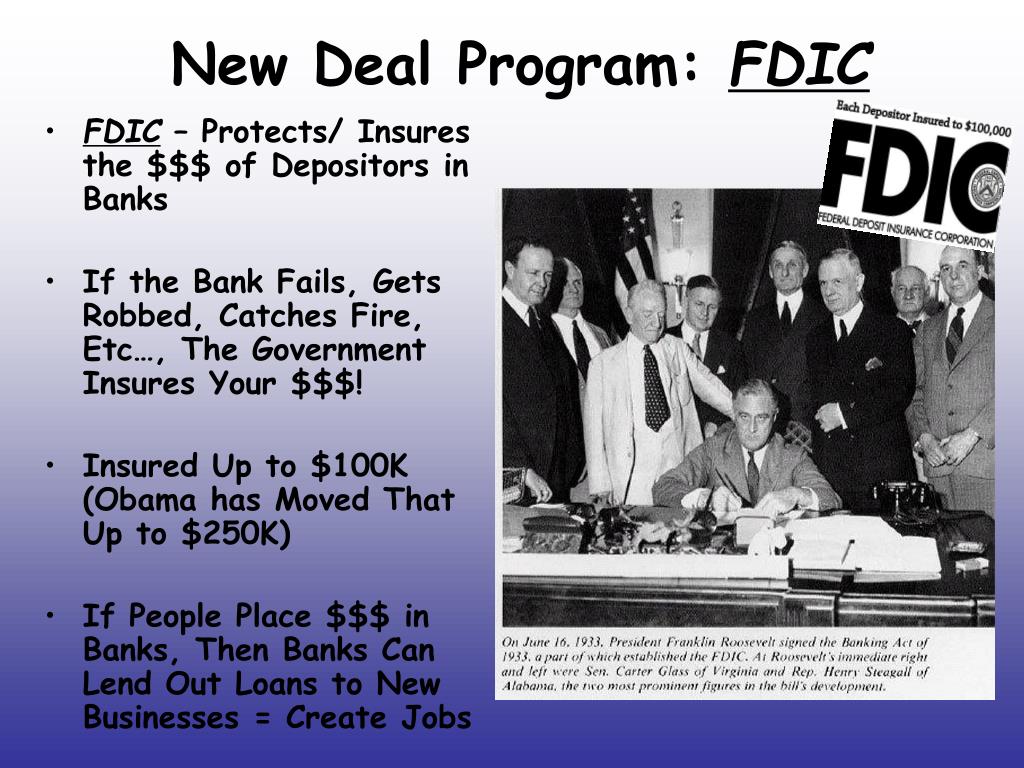

Deposit insurance is a type of insurance that protects depositors in case of bank failures. The FDIC, an independent agency created by the US government, provides deposit insurance to banks and thrifts (savings associations). The FDIC's primary goal is to maintain stability and public confidence in the US financial system. By insuring deposits, the FDIC ensures that depositors can access their insured funds even if their bank fails.

How Does Deposit Insurance Work?

The FDIC provides deposit insurance coverage up to $250,000 per depositor, per insured bank. This means that if you have multiple accounts in the same bank, the FDIC will insure up to $250,000 of your total deposits. The insurance coverage includes:

Checking and savings accounts

Money market deposit accounts

Certificates of deposit (CDs)

Bank individual retirement accounts (IRAs)

To qualify for FDIC insurance, banks must meet certain requirements and pay premiums to the FDIC. In return, the FDIC provides insurance coverage to depositors, reimbursing them for their insured deposits in the event of a bank failure.

Benefits of Deposit Insurance

Deposit insurance offers numerous benefits to individuals and businesses, including:

Peace of mind: Knowing that your deposits are insured can provide peace of mind, allowing you to focus on your financial goals without worrying about the safety of your funds.

Protection against bank failures: In the unlikely event of a bank failure, the FDIC will reimburse you for your insured deposits, ensuring that you don't lose your hard-earned money.

Increased confidence in the banking system: Deposit insurance helps maintain public confidence in the US financial system, promoting stability and economic growth.

In conclusion, deposit insurance is a vital component of the US financial system, providing protection and peace of mind to depositors. The FDIC's deposit insurance coverage ensures that your savings are safe, even in the event of a bank failure. By understanding how deposit insurance works and the benefits it provides, you can make informed decisions about your finances and enjoy greater confidence in the banking system. Visit

FDIC.gov to learn more about deposit insurance and how it can protect your savings.

Remember, your deposits are insured, and with the FDIC's protection, you can trust that your money is safe and secure. Whether you're an individual or a business, deposit insurance is an essential aspect of maintaining financial stability and security. Take the first step towards protecting your savings today and learn more about the benefits of deposit insurance.