As the world of stock trading continues to evolve, investors are constantly seeking ways to stay ahead of the curve. One valuable tool in their arsenal is premarket stock trading data, which provides insight into the potential direction of the market before the official opening bell. In this article, we'll delve into the world of Dow, S&P, and NASDAQ futures, exploring how premarket data can inform investment decisions and help traders navigate the complexities of the stock market.

What is Premarket Stock Trading Data?

Premarket stock trading data refers to the buying and selling of securities before the official market opening. This data is typically available through futures contracts, which are agreements to buy or sell a particular asset at a predetermined price on a specific date. By analyzing premarket data, investors can gauge market sentiment, identify trends, and make informed decisions about their investment portfolios.

Dow, S&P, and NASDAQ Futures: A Brief Overview

The Dow Jones Industrial Average (DJIA), S&P 500, and NASDAQ Composite are three of the most widely followed stock market indices. Each index has its own corresponding futures contract, which allows investors to trade on the expected future value of the index.

Dow Jones Futures: The Dow Jones futures contract is based on the DJIA, a price-weighted index of 30 large-cap stocks. Dow futures are traded on the Chicago Mercantile Exchange (CME) and are often used as a benchmark for the overall health of the US stock market.

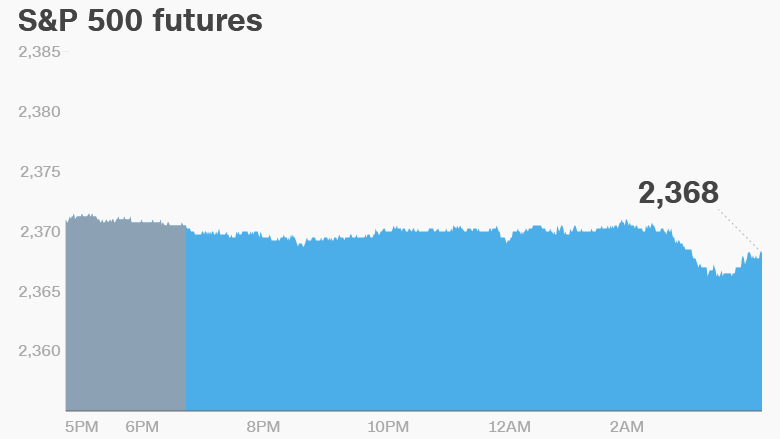

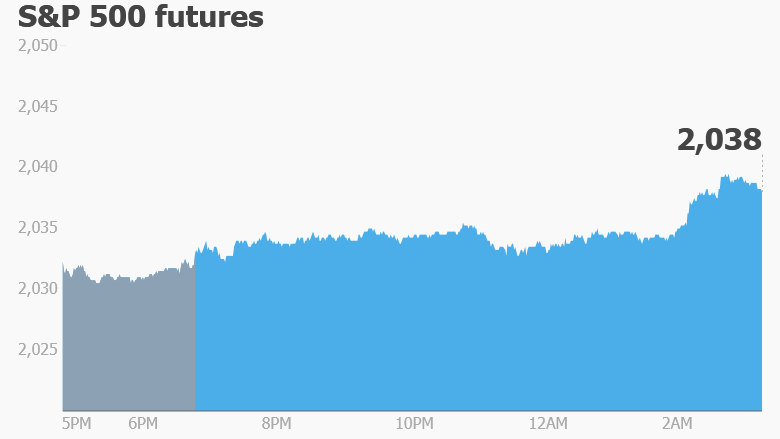

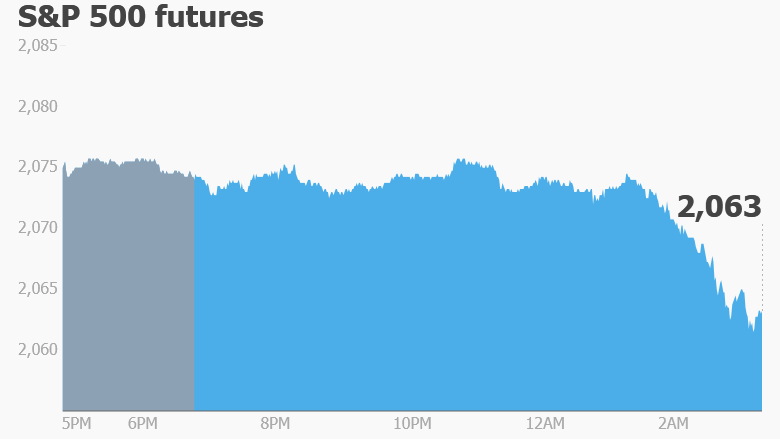

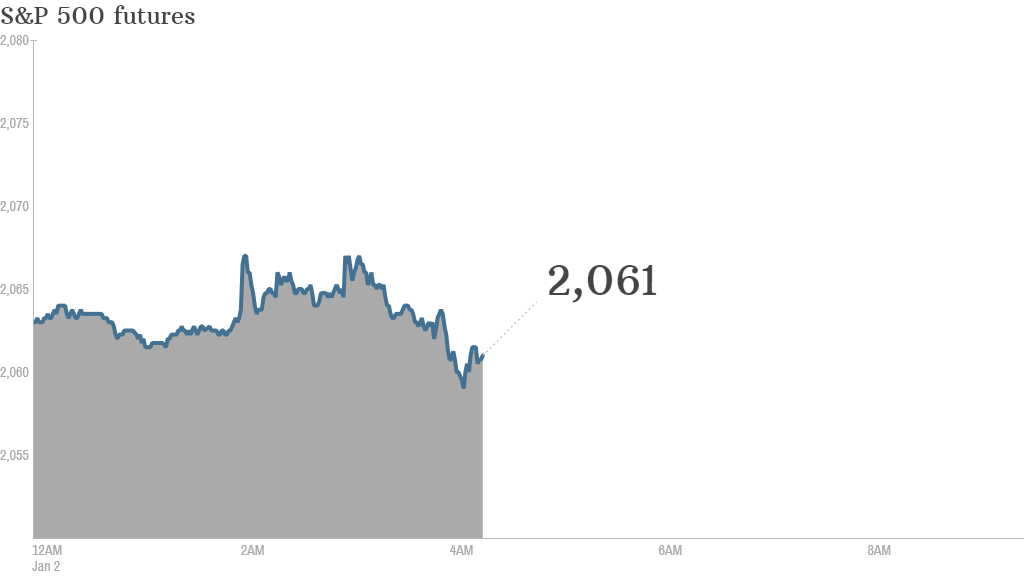

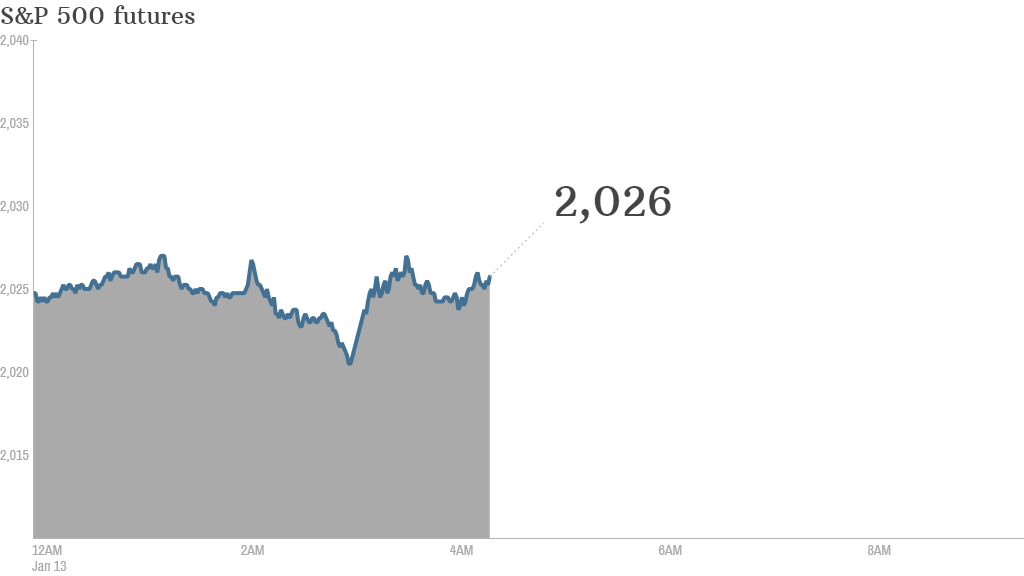

S&P 500 Futures: The S&P 500 futures contract is based on the S&P 500 index, a market-capitalization-weighted index of 500 large-cap stocks. S&P 500 futures are also traded on the CME and are widely used as a proxy for the US stock market.

NASDAQ Futures: The NASDAQ futures contract is based on the NASDAQ Composite index, a market-capitalization-weighted index of over 3,000 stocks. NASDAQ futures are traded on the CME and are often used to gauge the performance of the tech-heavy NASDAQ index.

How to Use Premarket Stock Trading Data

Premarket stock trading data can be used in a variety of ways to inform investment decisions. Here are a few strategies:

Trend identification: By analyzing premarket data, investors can identify trends and patterns in the market, which can help inform buy and sell decisions.

Market sentiment analysis: Premarket data can provide insight into market sentiment, allowing investors to gauge the level of optimism or pessimism in the market.

Risk management: By monitoring premarket data, investors can adjust their portfolios to mitigate potential losses or capitalize on potential gains.

Premarket stock trading data is a valuable tool for investors seeking to stay ahead of the curve. By analyzing Dow, S&P, and NASDAQ futures, investors can gain insight into market trends, sentiment, and potential risks. Whether you're a seasoned trader or just starting out, incorporating premarket data into your investment strategy can help you make more informed decisions and achieve your financial goals. Remember to always do your own research, set clear goals, and consult with a financial advisor before making any investment decisions.

Note: This article is for informational purposes only and should not be considered as investment advice. Trading in the stock market involves risks, and investors should always do their own research and consult with a financial advisor before making any investment decisions.