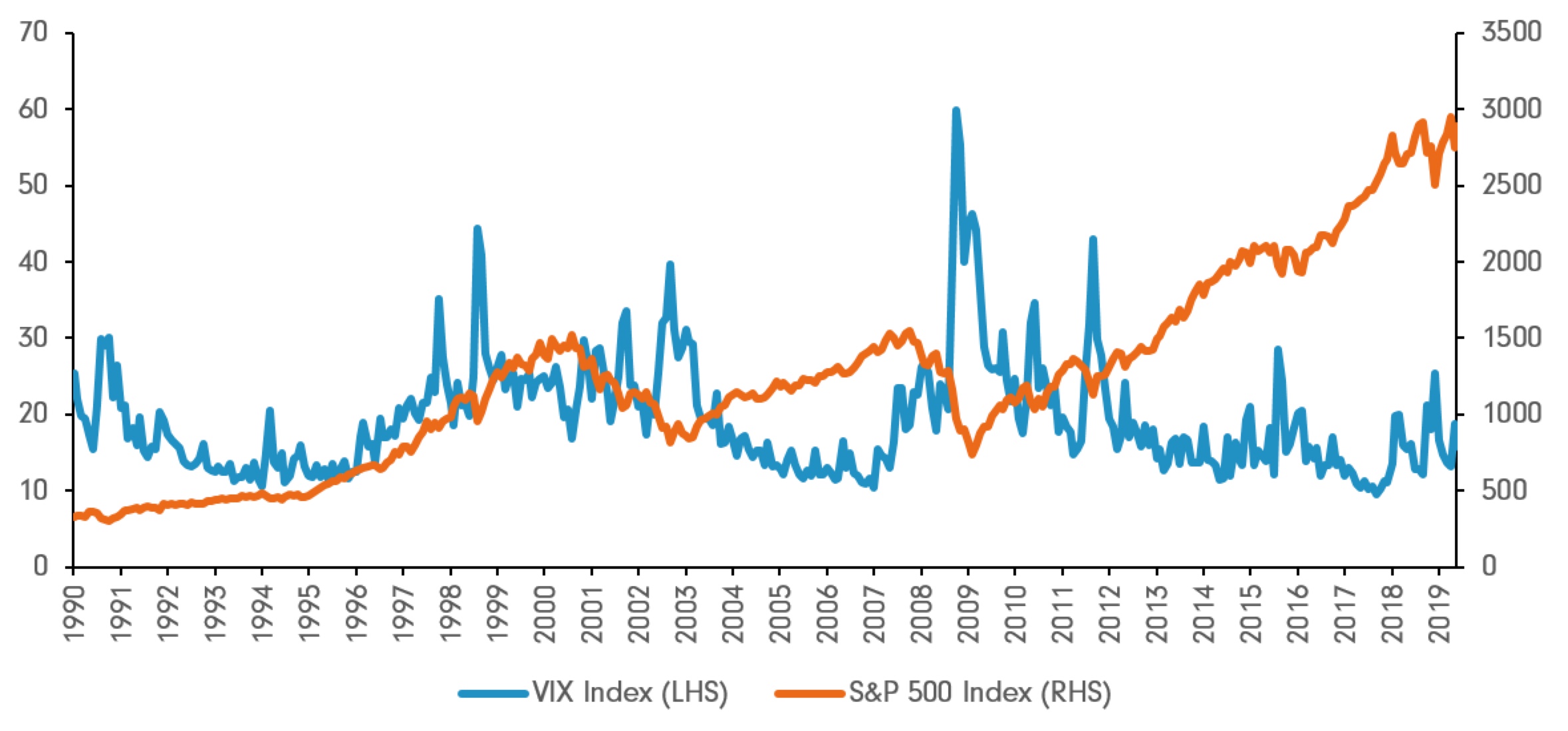

The VIX index, often referred to as the "fear index," has become a widely followed indicator in the financial world. It's a benchmark that measures the expected volatility of the S&P 500 index, providing investors with valuable insights into potential future stock market changes. In this article, we'll delve into the world of VIX, exploring how it works and what it can reveal about the market's future direction.

What is the VIX Index?

The VIX index, also known as the Chicago Board Options Exchange (CBOE) Volatility Index, is a calculation of the expected volatility of the S&P 500 index over the next 30 days. It's based on the prices of call and put options on the S&P 500, which reflect the market's expectations of future price movements. The VIX index is often seen as a gauge of investor fear, as higher readings indicate increased uncertainty and anxiety in the market.

How Does the VIX Index Work?

The VIX index is calculated using a complex formula that takes into account the prices of various S&P 500 options. The calculation involves the following steps:

Collecting data on the prices of S&P 500 call and put options with different strike prices and expiration dates.

Using a weighted average of the option prices to calculate the expected volatility of the S&P 500 index.

Applying a formula to convert the expected volatility into a VIX index value, which is expressed as a percentage.

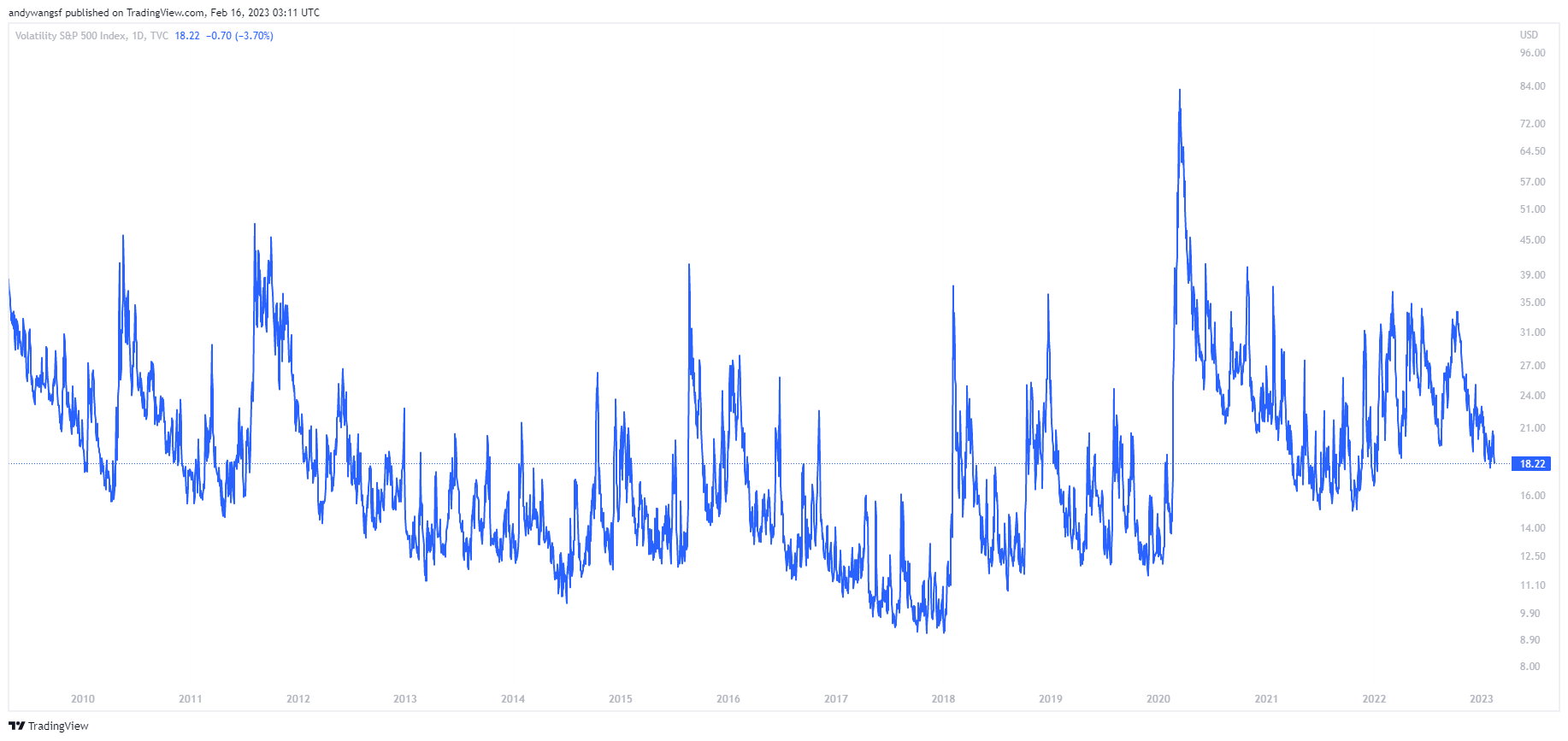

The resulting VIX index value represents the market's expected volatility over the next 30 days, with higher values indicating greater expected volatility.

Interpreting the VIX Index

So, how can investors use the VIX index to predict future stock market changes? Here are a few key takeaways:

High VIX readings: A high VIX index value (typically above 20) indicates increased market uncertainty and fear. This can be a sign that the market is due for a correction or a period of high volatility.

Low VIX readings: A low VIX index value (typically below 15) suggests that the market is relatively calm and complacent. This can be a sign that the market is due for a rally or a period of low volatility.

VIX spikes: A sudden spike in the VIX index can indicate a significant increase in market uncertainty, often in response to unexpected events or news.

While the VIX index is not a crystal ball, it can provide valuable insights into market sentiment and potential future volatility. By monitoring the VIX index and understanding its implications, investors can make more informed decisions about their investment strategies.

The VIX index is a powerful tool for investors looking to gauge market sentiment and potential future volatility. By understanding how the VIX index works and how to interpret its readings, investors can gain a valuable edge in the market. Whether you're a seasoned trader or just starting out, the VIX index is an important indicator to watch, as it can provide valuable insights into the market's future direction. So, keep a close eye on the VIX index and stay ahead of the curve in the ever-changing world of finance.